Government Spending & Taxes

— May 7, 2024

— Apr 30, 2024

— Apr 23, 2024

— Apr 9, 2024

Read the Full Report

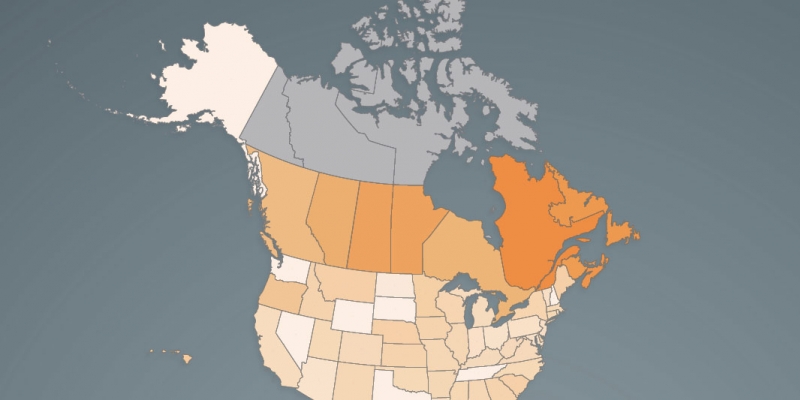

Read the Full Report View the Infographic - Income Tax Rate at CA$50,000

View the Infographic - Income Tax Rate at CA$50,000 View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$50,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$75,000

View the Infographic - Income Tax Rate at CA$75,000 View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada)

View the Infographic - Income Tax Rate at CA$75,000 (Atlantic Canada) View the Infographic - Income Tax Rate at CA$150,000

View the Infographic - Income Tax Rate at CA$150,000 View the Infographic - Income Tax Rate at CA$300,000

View the Infographic - Income Tax Rate at CA$300,000 Read the News Release - Canada

Read the News Release - Canada Read the News Release - Atlantic Canada

Read the News Release - Atlantic Canada

— Apr 3, 2024

— Mar 28, 2024

Read the Essay - Canada's Carbon Tax Plan is Beyond Policy Redemption

Read the Essay - Canada's Carbon Tax Plan is Beyond Policy Redemption Notes and References - Canada's Carbon Tax Plan is Beyond Policy Redemption

Notes and References - Canada's Carbon Tax Plan is Beyond Policy Redemption Read the Essay - Reforming the Federal Government's Carbon Tax Plan

Read the Essay - Reforming the Federal Government's Carbon Tax Plan Notes and References - Reforming the Federal Government's Carbon Tax Plan

Notes and References - Reforming the Federal Government's Carbon Tax Plan Read the News Release

Read the News Release

Subscribe to the Fraser Institute

Get the latest news from the Fraser Institute on the latest research studies, news and events.

Research Experts

-

Executive Vice President, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Professor of Economics, Lakehead University

-

Senior Fellow, Fraser Institute

-

Senior Economist, Fraser Institute

-

Professor of Economics, MacEwan University

-

Senior Fellow, Fraser Institute

-

Director, Fiscal Studies, Fraser Institute

-

Assistant Professor of Economics, George Mason University

-

Associate Director, Alberta Policy, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Policy Analyst, Fraser Institute

-

Senior Fellow in the Centre for Economic Freedom, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Director, Addington Centre for Measurement, Fraser Institute

-

Senior Fellow, Fraser Institute

-

Senior Fellow, Fraser Institute

-

President, Fraser Institute

-

Fraser Institute Founder and Honorary Director

-

Senior Fellow, Fraser Institute

-

Associate Director, Atlantic Canada Prosperity, Fraser Institute